We have a lot of clients asking us – Can I use my Super to purchase property?

Yes you can, most lenders will lend up to 70% of the property value within SMSF. Some are able to lend more, but you may pay a higher rate. We currently have Self Managed Super Fund (SMSF) finance offerings of around 7.17% pa on a 70% lend.

We are happy to look over your super balances, and point you in the right direction towards your next purchase. A good amount of superannuation to start investing in property is around $300,000. Couples can also combine their super into a famly superannuation fund and this can help to build that property buying power!

You must speak with a professional financial planner to get some financial advice before deciding to invest your super into property. A great financial planner will be able to advise you on the different strategies to suit your circumstances. There are a few rules to be aware of when deciding to own property within an SMSF:

- Must be commercial or investment

- A member cannot live in it

- Lenders also have restrictions in terms of postcodes and use of the property, so it’s always a great idea to talk to a broker to check if the property will be suitable before embarking on the purchase journey.

- You must receive independant financial advice, legal advice and accounting advice.

Why should I use my SMSF for property investment?

Leveraging your super to finance a property purchase means giving you control and flexibility over your retirement savings. It’s a smart way to grow your wealth while planning for the future!

We recently spoke with Matt from Sharp Property Buyers. Matt and his team recently purchased a property for an SMSF client.

The property was purchased for $620,000. It is a 4 bed, 2 bath, 2 car property on a 560sqm block with a rental return of $560 per week or a yield of 4.69%.

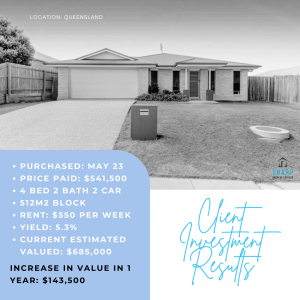

Matt and his team are very experienced in picking the perfect property for clients SMSF investments, with some recent highlights below:

What sort of properties can I purchase within my SMSF?

A buyers agent can help you search for the right type of investment property for your SMSF. Your Self Managed Super Fund can invest in residential, commercial, and even industrial properties! Diversify your portfolio and build wealth for your retirement.

What is the first step to buying a property with my self managed super fund?

The first step to buying a property with your Self Managed Super Fund (SMSF) is setting up the fund correctly. An accountant can help you with this process – the costs vary, however a good range of set up costs is between $2000 and $4000 to have everything set up correctly. This means ensuring your fund is compliant with all regulations.

Send us an email today and we can help to put you in touch with a financial advisor and accountant to make the process seamless. We partner with some trusted advisors that we just know our clients will love!